Not only is Sacramento one of the most affordable major cities in California, it’s also a business and cultural hot spot, attracting medical professionals, entrepreneurs and other creative professionals. Low-cost living as well as excellent schools and a booming housing market are a few reasons to want to own a home here— but did you know that there are several tax benefits as well?

From property tax deductions to exemptions offered by certain school districts, municipalities and counties, there are plenty of perks available to homeowners in Sacramento. Keep reading for tips to help you out this tax season!

1. Say Thanks to Proposition 13

In California where home values tend to be higher as compared to other states, property taxes are limited by Proposition 13 or “Prop 13.” This proposition rolled back most local real estate assessments to 1975 market value levels, limited the property tax rate to 1 percent plus the rate necessary to fund local voter-approved bonded indebtedness, and limited future property tax increases to a maximum of 2% per year.

More easily understood, California’s overall property taxes are below the national average due to Proposition 13. This is excellent news for those considering a move to Sacramento from regions with lower home values, as it helps ease the potential "shock" of purchasing a higher-valued home in California.

2. Take Advantage of Sacramento’s Tax Savings Program for Homeowners

The Homeowners' Exemption provides homeowners a discount of $7,000 of assessed value resulting in a savings of approximately $70-$80 in property taxes each year. Not a huge savings, but since this is a free program there’s nothing to lose and perhaps a paid-for DoorDash order to gain? There are a few qualifications an application is required. In addition to being a You must be a property owner, co-owner or a purchaser named in a contract of sale, the home must be used as a primary residence. Head over to the

Sac County assessor’s website for more information.

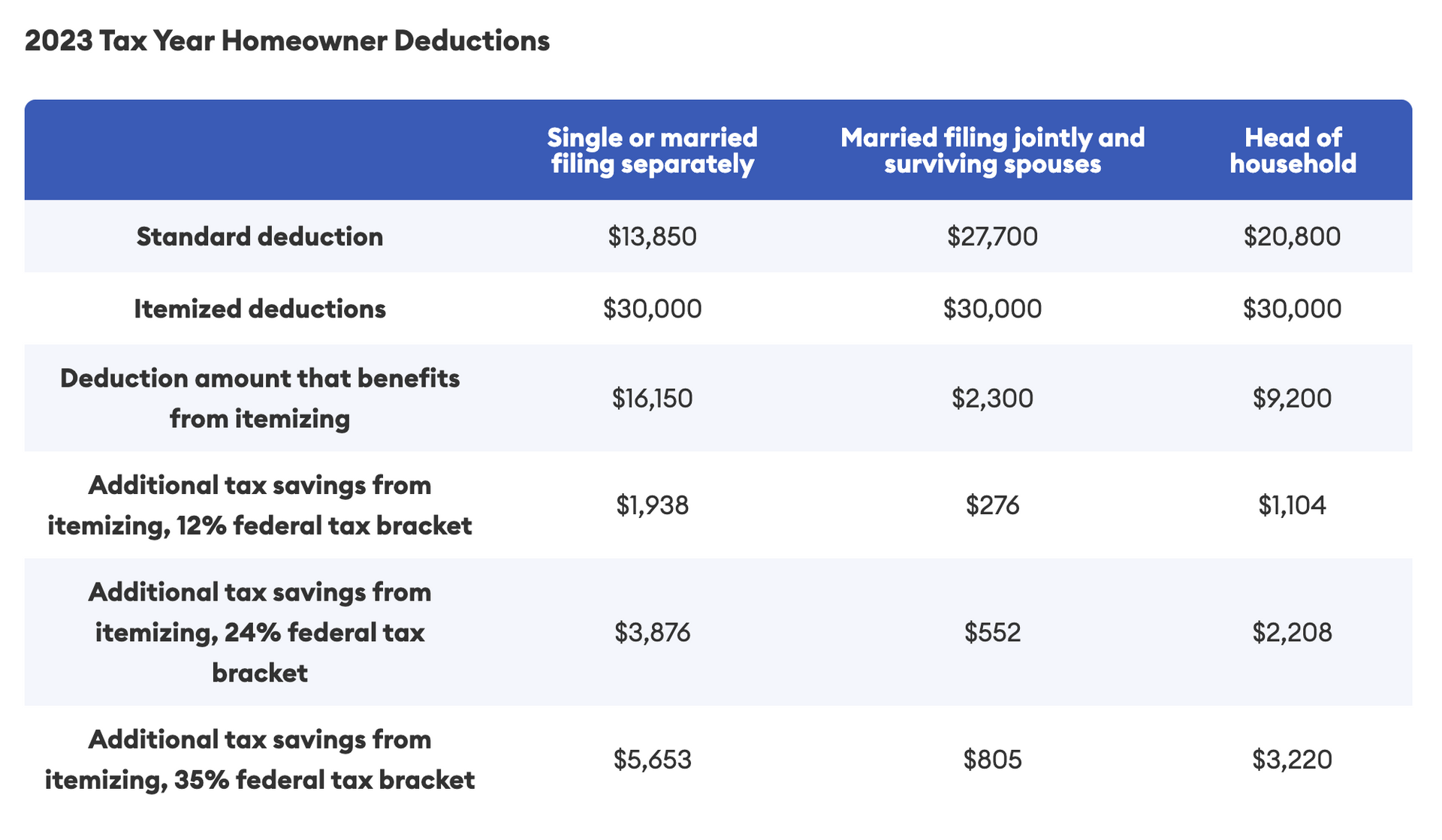

3. Deduct Your Mortgage Interest

Homeowners with mortgages not exceeding $750,000 can deduct the interest on their loans, which is arguably one of the best tax advantages of homeownership. This deduction has been facilitated by the Tax Cuts and Jobs Act (TCJA), which lowered the limit from the previous $1 million. Additionally, homeowners can deduct interest on up to $100,000 of home equity debt, regardless of the purpose for which the borrowed money was used.

4. Deduct Mortgage Insurance Premiums

Did you purchase your home in 2007 or after or are thinking about buying a home this year? You would be eligible to deduct mortgage insurance premiums, including PMI. For tax returns filed as "Married Filing Separate," the deduction begins to phase out when the adjusted gross income exceeds $50,000. For all other types of tax returns, the deduction phases out when the adjusted gross income exceeds $100,000.

5. You Can Take Money Out of Your IRA to Help Buy Your House, Penalty-Free

Sometimes the most difficult part of purchasing a home is coming up with the funds to either buy down the rate, get the down payment, or cover other costs associated with closing. If you have an Individual Retirement Account (IRA), the IRS allows you to withdraw up to $10,000 individually (or $20,000 for married couples) from your IRA for your down payment. The best part—you won’t incur the usual 10% penalty reserved for withdrawals before the age of 59-1/2. Just remember, you must utilize these IRA funds within 120 days of withdrawal. While this perk typically caters to first-time home buyers, even current homeowners can tap into this advantage provided they haven't owned a home in the past two years.

6. Use the Property Tax Deduction to Save Up to $10,000

Another valuable benefit for homeowners is being able to deduct property taxes, up to $10,000. It's important to remember that this deduction only applies to taxes on properties you own and live in, not for rental or commercial properties.

To claim your property tax deduction:

- If your lender handles tax payments through an escrow account, you can find the tax amount on your IRS Form 1098 for easy deduction.

- If you pay taxes directly to your municipality, keep records of your payments for deduction purposes.

7. You Can Deduct a Portion of Your Mortgage if You Work from Home

Have you been working from home recently? If you operate a home-based business, you may be eligible for the Home Office Deduction, which applies to both renters and homeowners. This tax relief requires utilizing part of your home for business. Check the IRS guidelines for eligibility and requirements.

Tax season is right around the corner! We hope these tips help you take advantage of all the deductions available to Sacramento County homeowners. When considering financial advice from The Sherri Patterson Team, we encourage you to consult with a professional for expert guidance.

Need help? Reach out to us for recommendations! We’re connected to some great CPAs and financial advisors in the Sacramento County area.