The Coronavirus threw a couple of curve balls into the 2021 tax season—including giving us an extra month to file. We’re back to business as usual with the 2022 tax season, but there are a few changes.

Some new things this year include an increase in charitable giving deductions (if you don’t itemize) and the expanded Child Tax Credit (parents, you noticed some extra cash in your bank account or mailboxes last year, yes?).

In this article, we’ll dig into both of those changes, plus a few more.

- The big tax deadline for all federal tax returns and payments is April 18, 2022.

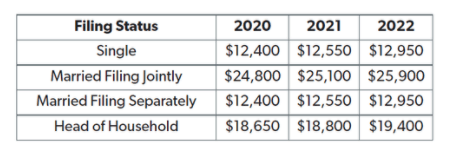

- The standard deduction for 2021 increased to $12,550 for single filers and $25,100 for married couples filing jointly.

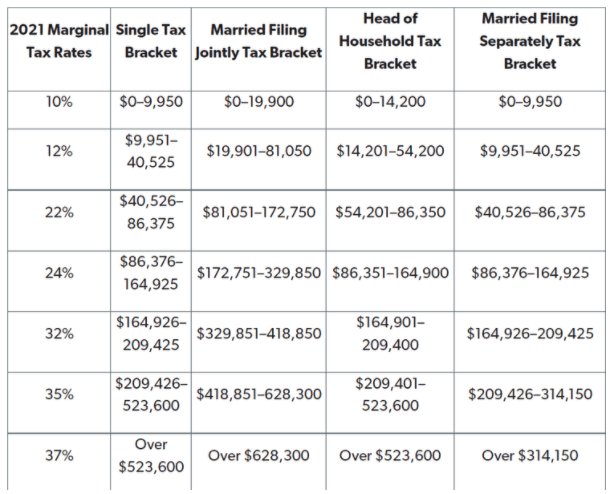

- Income tax brackets increased in 2021 to account for inflation.

But this is just the tip of the iceberg. Let’s dig into the details so you can file your taxes with confidence this year.

INCOME TAX BRACKETS INCREASED

For the 2021 tax year, the tax rates are the same—but there are some slight changes to the brackets. Basically, the brackets have been adjusted by a few hundred dollars from 2020 to account for inflation. Take a look at the chart below to see what tax bracket you will fall under this year.

Keep in mind that every situation is different as far as whether you should take the standard deduction or whether you should itemize. Talk to a tax pro to figure out what's best for you. We recommend contacting Khinh Hoang at PSG Certified Public Accountants in Roseville!

HIGHER STANDARD DEDUCTIONS

You have the option of taking the standard deduction or itemizing your deductions—calculating your deductions one by one. The rule of thumb is if your itemized deductions exceed the amount of the standard deduction, you should itemize. For tax years 2021 and 2022, the standard deduction went up slightly to adjust for inflation. Check out the table below:

CHILD TAX CREDITS INCREASED

If you got any checks in the mail or deposits in your bank account from the U.S. Treasury last year, that was the American Rescue Plan. It increased the Child Tax Credit from $2,000 to $3,600 for each child under age 6 and to $3,000 for each child 6–17. These were advance monthly payments ($300 per month for each child under 6 and $250 for each child 6 to 17) given out rather than having to wait until tax time for families to claim this credit.

While these advances were convenient, keep in mind that taking those payments last year will reduce the amount you get at tax time. Payments are based on your 2020 taxes, so if your income went up enough in 2021 to start closing in on the phase-out limit for the credit, you might consider opting out of advance payments.

Photo by Jonathan Borba on Unsplash

MORE WAYS TO SAVE (DEDUCTIONS, DEDUCTIONS, DEDUCTIONS)

1. Charitable Deductions

The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended two charitable giving changes enacted by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The law allows you to deduct up to 100% of your adjusted gross income (AGI), which is your total income minus other deductions you have already taken, in qualified charitable donations if you plan to itemize your deductions.

2. Medical Deductions

If you found yourself with hefty medical bills last year, you might be able to find at least some tax relief (if you’re itemizing this year). Consult with a tax professional or do your research to find out if you have qualifying medical deductions. You can deduct any medical expenses above 7.5% of your adjusted gross income (AGI), which is your total income minus other deductions you have already taken.

3. Business Deductions

If you’re self-employed (and only if you’re self-employed; not a remote W-2 employee), there are a bunch of deductions you can claim on your tax return—including travel expenses and the home office deduction if you use a part of your home to conduct business.

4. Earned Income Tax Credit

The EITC is a refundable credit designed to help out low- and middle-income households. The maximum adjusted gross income for a single filer with no children is $21,430, while the cap for a married couple with three or more children is $57,414. Depending on your income, your filing status and number of children, the credit could save you anywhere from a few hundred to a few thousand dollars on your taxes.

About our Team

The Sherri Patterson Team specializes in residential real estate and relocation, with a combined 75+ years of experience serving the Sacramento, El Dorado, Placer and Yolo counties. We work directly with hospitals, physicians and medical professionals. Whether you're looking to buy, sell or relocate to the Greater Sacramento area, we are the premier real estate team of choice. Our office is located at Keller Williams in Folsom, CA