Now that we're officially one month into the new year we are starting to get a slightly better view of how the 2023 market will perform. It’s important to keep watching different key metrics such as: pending home sales, actives, and prices to understand what is normal and what is not. Below we've shared some analysis, based on what we know so far! This post is a mix of our own research, stats from Lawerence Yun, Chief Economist at the National Association of Realtors and this blog post from the Sacramento Appraisal Blog.

Let's jump in!

Temperature shock: We had the worst monthly volume ever in the Sacramento region over the past 90 days. Rising interest rates, combined with high homes prices lead to a slow fall and winter season. A stark contrast from the hot market we had leading up to summer 2022. As we enter a new year it seems that buyers are warming up to the new reality that interest rates and home prices will not drop drastically. Time will tell.

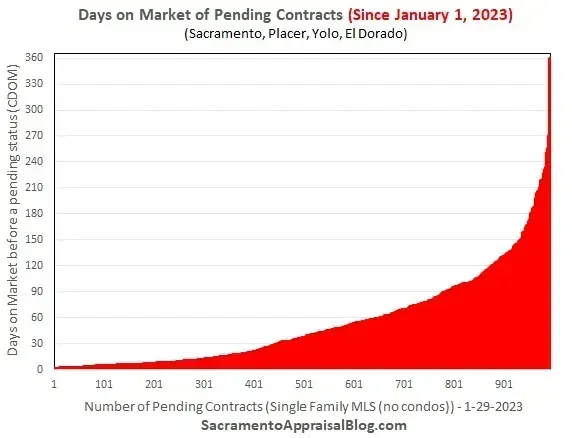

Buyers are targeting older listings: Buyers are targeting new listings, but homes that have been sitting on the market are also going under contract. 31% of pendings in January were units that listed since January, but 69% of pending contracts were listed before the new year. Nearly 18% of pendings listed before October 2022. Buyers aren’t overlooking older listings. They are looking for homes priced right.

The spring feels warm, but not 2021 hot: The housing market was moving about twice as fast as usual for most of 2021, but that’s not the case so far in 2023. So far, we’re seeing typical signs of a spring season with more pendings, properties getting into contract quickly, more multiple offers, more mortgage applications, and new listings. The number of mortgage applications and pending contracts are still down though, so it's a little premature to say just how hot the spring 2023 market will be.

Higher-priced listings in 2023: Larger homes are listing (normal spring trend), which means buyers are finally starting to have a higher-quality selection. Pendings in January are listed about 1% higher than the median price of January’s closed sales and 3% higher than December (normal trend). In short, preliminary stats suggest we could see a spring price uptick. It’s still early to say this, but larger homes and higher prices in January suggest this could happen.

The right price moves quickly: It’s that time of year where it’s going to take less time to sell. 28% of pendings in January so far got into contract within ten days, and about 46% of units got into contract within thirty days of listing. This underscores the importance of pricing it right. Technically the average for pendings this month has been a whopping 60 days, and a number that big speaks to lots of properties that got into contract that were listed prior to January. But here’s a stunning stat. Active listings have been on the market 86 days, and that shows how many overpriced units there are right now.

Lower prices are hotter: The hottest price point in town is under $500,000. In fact, 40.7% of all pending contracts in the region since January have been under $500,000. A whopping 49.7% of these pendings had multiple offers too compared to 37.9% of units above $500,000. These numbers aren’t unexpected for what we should see since the bottom half of activity tends to be more competitive.

Not a buyer buffet: Buyers, you do have more power in today’s market, but there is still competition – especially for lower-priced units and homes that check all the boxes. In short, it’s not a buffet where you can take whatever you want at any price. For anyone buying right now, be confident in your decision, be patient, and get the most the market will give you.

Affordability is still an issue: It’s possible some buyers have gotten used to the idea of 6% rates, and some are finding a bit of affordability relief in light of a 15% dip in the median price last year. But we’re still missing a ton of buyers in the marketplace, and we need to see more affordability to get these buyers back.

Multiple offers: Getting multiple offers today isn’t always the same thing as 2021 where so many listings were bid up with contingencies removed. But let’s remember getting multiple offers is a normal part of the real estate experience for a portion of the market. 46% of pendings over the past two weeks had multiple offers, which is a pretty normal level for the time of year, and we SHOULD be seeing more multiple offers in the spring season.

Has the housing market bottomed out? There is lots of talk about the housing market bottoming out. Time will tell what happens ahead and how long this downward cycle will last, but with regards to pricing most economists are predicting a flat year ahead and somewhere between 15-25% appreciation over the next five years, but this could be uneven depending on where you live.

Pending volume is still subdued: The number of pending contracts is starting to see an uptick for the spring, but it’s still lower than a normal level. Experts are predicting volume to be down about 7% this year, but with prices dipping, we will see some buyers come back. If rates end up dropping too, that will help even more.

It's important to remember that real estate is hyper local and also an extremely personal decision. Life circumstances require people to sell their home regardless of the market. And for buyers it is hard to time the market perfectly. If you can afford a mortgage payment, today's market offers oppotunities we have not seen over the last two years. Consult with our team to learn more about whether 2023 is the right year to buy, sell or invest!