If you’re like us, you’re probably ready to move on from 2020. But there is one lingering ghost from last year that you need to get rid of before you can truly move on for good—and that’s your 2020 taxes.

Thanks to the coronavirus (among other things), a lot has changed for the 2021 tax season. That’s why you need to start thinking about your tax situation now while you still have time on your side. We want you to be prepared to tackle your taxes before they tackle you. And to do that, we’re going to dig into what’s new for this tax season and what’s staying the same.

First, here are the main things you need to know right off the bat for the 2021 tax season:

- Tax Day is Thursday, April 15, 2021. You must file your 2020 tax returns by this date!

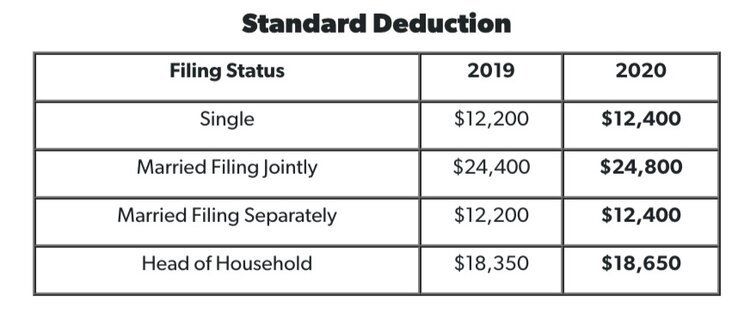

- The standard deduction for 2020 increased to $12,400 for single filers and $24,800 for married couples filing jointly.

- Income tax brackets increased in 2020 to account for inflation.

Keep in mind that every situation is different as far as whether you should take the standard deduction or whether you should itemize. Talk to a tax pro to figure out what's best for you. We recommend contacting Khinh Hoang at PSG Certified Public Accountants in Roseville!

The Coronavirus and Your Taxes

Oh, so you thought you were done with the coronavirus now that it’s 2021? Unfortunately, the coronavirus (and the government’s response to it) has created a ripple effect that will be felt when you sit down to file your taxes for last year. Here are some things to keep in mind:

STIMULUS CHECKS

The good news is your stimulus check will not count as taxable income. Instead, it’s being treated like a refundable tax credit for 2020. Translation: Your stimulus check is sort of like an advance on money you would have received anyway as part of your tax refund in 2021.

PAYCHECK PROTECTION PROGRAM (PPP) LOANS

The CARES Act also tried to help struggling small business owners stay afloat by offering them Paycheck Protection Program (PPP) loans. As long as these loans were used on certain business expenses—payroll, rent or interest on mortgage payments, and utilities, to name a few—these loans were designed to be “forgiven.” In December 2020, the IRS announced that any eligible expenses you paid with money from those PPP loans can be deducted from your taxable income. So that’s a little bit of good news! But remember, you’ll have to get your loan forgiveness application approved by the Small Business Administration before you’re off the hook for the amount you borrowed.

UNEMPLOYMENT BENEFITS

Many Americans found themselves out of work (at least temporarily) after the pandemic shut down a large part of the economy and turned to unemployment insurance for help. Those who received unemployment benefits will need to pay income taxes on that money.

If you chose not to have taxes withheld from your benefits when you signed up, then you’ll either have to pay quarterly estimated taxes or set aside enough money from your unemployment benefits to pay your taxes come Tax Day.