When it comes to building credit, it can be difficult to tell fact from fiction. Use this short true-or-false quiz to help you get the facts straight and your credit in great shape!

TRUE OR FALSE?

Any debt will hurt my credit. FALSE: An outstanding mortgage being paid on time isn’t the same as $30,000 worth of credit card debt. An outstanding mortgage that’s paid on time is considered “good debt,” and it can raise your score. Stay away from consumer debt!

When I pay off my debt, it’ll disappear from my credit report. FALSE: Paid debt will remain on your credit report for several years. If it was paid on time, it can boost your score. Bankruptcy, defaulted loans and other negative information can hurt, sticking around for 7-10 years.

Even though I got a promotion my credit score is unaffected. TRUE: Income and job title may indirectly affect your score, but salary is not factored into your report. Still, head’s up — lenders may ask about your employment to determine how likely you are to pay your debts.

My spouse and I can run a joint credit report. FALSE: Each individual receives their own credit score. Your joint accounts and shared loans may impact each of your scores, since they will appear on each of your reports.

Closing my paid-off credit card isn’t going to help my credit score. TRUE: It may pay to keep it open. Closing an unused card reduces your amount of credit and limits your credit history, which can sometimes lower your credit score. But if that credit card is tempting you to spend, close it!

Checking my own credit score won’t impact it. TRUE: Running your own credit report does not negatively impact your score. When a lender checks for a mortgage, car loan or credit card application, it may lower your score a few points.

Get your free annual credit report at Annual Credit Report

Check your credit score for free with Credit Karma, Credit Sesame, Credit.com, Equifax, Experian or Mint

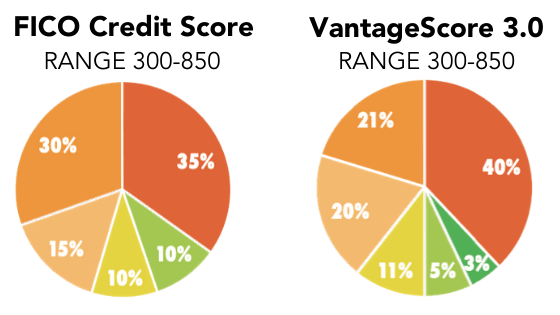

Between FICO®, VantageScore and other models, there is no single way to calculate your credit score. Take a look at the top two models and how they are calculated.

- 35% Payment History

- 30% Credit Utilization

- 15% Length of Credit History

- 10% Credit Mix

- 10% New Credit & Recently Opened Accounts

- 40% Payment History

- 21% Duration & Type of Credit

- 20% Credit Utilization

- 11% Total Balances

- 5% Recent Behavior

- 3% Available Credit

FICO is the most common credit ranking. Score varies depending on the reason for the loan. Your result for an auto loan might be different than your score for a department store credit card.

Developed by the major credit reporting bureaus, this model is used by some popular free credit report sites as well as lenders, landlords and financial institutions to see if you are credit worthy. Your score will be similar but rarely identical to FICO.

About our Team

The Sherri Patterson Team specializes in residential real estate and relocation, with a combined 75+ years of experience serving the Sacramento, El Dorado, Placer and Yolo counties. We work directly with hospitals, physicians and medical professionals. Whether you're looking to buy, sell or relocate to the Greater Sacramento area, we are the premier real estate team of choice. Our office is located at Keller Williams in Folsom, CA